Content

It includes rent tracking, expense management, budgeting, financial reporting, and compliance with accounting standards. Accounting and bookkeeping for property management are not for the weak of the heart. Property managers are typically expected to monitor an owner’s real estate income, assets, and expenses and implement accounting procedures that support sound business growth and profitability. Real estate accounting can be a complex and time-consuming task, but it is also essential for the success of any real estate business. Proper accounting allows investors, property owners, and real estate professionals to track their income and expenses, analyze their financial performance, and make informed decisions about their operations.

What is the role of property asset management?

The broad objective of asset management is to maximize property value and investment returns. This means reducing expenditures when possible, finding the most consistent and highest sources of revenue, and mitigating liability and risk, among other things.

Since they have already been pre-interviewed and vetted, you won’t have to put your time and effort into the tedious onboarding procedures. Businesses increasingly prefer using virtual bookkeepers because they provide several significant advantages. But with so many tasks on their plate, it becomes pretty challenging to manage your books as well.

Choose a Bookkeeping Method

Establishing proper trust fund accounts for your property management business helps ensure that funds are used for their intended purpose. According to Propertymanager.com, misuse of trust accounts is the leading reason property management companies are audited. Wave Property Management is a full-service leasing and management company serving Boise as well as nearby communities such as Meridian, Garden City, Nampa, Mountain Home, and Caldwell. We work with new rental property owners as well as established investors with growing real estate portfolios.

- The main difference between the 2 is in the timing for recognizing revenue and expenses.

- If you’ve ever run a report in QuickBooks or a similar accounting software to see your revenue, expenses, or other factors, you’ll recognize that every report uses an accounting period.

- Hiring a virtual bookkeeper for QuickBooks is a great way to lighten your workload and have an experienced bookkeeper manage your money.

- In single-entry, all financial items, both incoming and outgoing, are entered just once.

Your software’s built-in financial reports will be automatically refreshed to reflect your latest data. That means that with the click of a button, you should be able to download a fully up-to-date P&L statement (income statement), balance sheet, cash flow statement, and more. One of the easiest ways to reduce accounting risks is to use reliable and secure accounting software that can automate your bookkeeping, invoicing, reporting, and tax filing.

Have Separate Accounts for Administrative and Property Management Operations

From rent collection to vendor invoice management, it is important that you have a sound foundation in bookkeeping principles, established processes, and reliable property management accounting software. By applying the property management accounting best practices above, you can rest assured that your rental property is generating income. Just remember to have a backup for your records, whether it’s a hard copy, on the cloud, or a spreadsheet. This is to ensure that your records are safe against any threats, like theft.

What is management accounting in one sentence?

One simple definition of management accounting is the provision of financial and non-financial decision-making information to managers. In other words, management accounting helps the directors inside an organization to make decisions. This can also be known as Cost Accounting.

In the context of property, assets could depreciate with excessive use or deteriorating condition. Understanding depreciation is handy for predicting the value of your assets over time. A common approach to setting up your chart of accounts is to use a block numbering system. NorthOne is proudly made for small businesses, startups, and freelancers.

WS1722 Real Estate Success Highlights Whitney Sewell

Once you’ve opened a business account, keep in mind that all income coming from the property must go into the business account. Also, any expenses made, like repair and maintenance costs, must be paid using that account. Whether you’re renting a single unit or multiple ones, it’s important to always consider it as a business.

By methodically logging and organizing financial transactions, bookkeeping serves as the foundation of efficient property management. Property managers can make knowledgeable decisions and create reasonable budgets by using proper bookkeeping procedures to get a clear and accurate understanding of a property’s financial health. Property managers during the pandemic adjusted not only to new health and safety protocols but economic fallout that made it exceedingly difficult for many tenants to pay rent. With the rise of virtual showings, online payments, and applications during the pandemic, property managers pivoted to new ways of operating in a crisis. Following these principles will help your business stay in compliance with the applicable financial regulations and will assist your company’s record-keeping practices. This property management account tip also saves you and the tenets a lot of time.

Stay informed about changes in tax laws and regulations, and consult with a tax professional if you have any questions. This can help you avoid mistakes that could cost you money or result in penalties. If you want to get a loan on the property or sell it, the first thing you will be asked for is a rent roll. Having one accurate and up to date will go a long way toward making interacting with third parties easier — not to mention helping you identify delinquent tenants faster. This means the tenants are responsible for paying their share of all common area expenses such as landscaping or snow removal. If you have NNN leases, you need to keep up on common area expenses and bill tenants annually.

- A content writer professionally, Shaurya is someone who loves cooking exotic meals in her free time and poetically romanticizing the world with a camera in one hand and a pen in another.

- For example, if you notice that your expenses are consistently exceeding your income, you may need to take action to reduce your costs or increase your revenue.

- Plus, if you have residential and commercial properties, Total Management can handle both.

- Also, any expenses made, like repair and maintenance costs, must be paid using that account.

- Not only will this approach make it easier for you to automate processes in the long run, but this also will make your property management accounting simpler and easier to follow.

- For example, you might have separate categories for property management fees, repairs and maintenance, and marketing expenses.

No risk shall be taken in maintaining accounts because if accounts aren’t made properly, the company might land in trouble in the long run. With the two condos that I personally own, I use a website called Cozy to do monthly rent payments and have a credit card that I only use for the investment properties. I generally have four or five non-HOA (homeowner’s association) expenses annually, so it’s easy enough to throw it all together on a spreadsheet at the end of the year.

Do the monthly accounting cycle

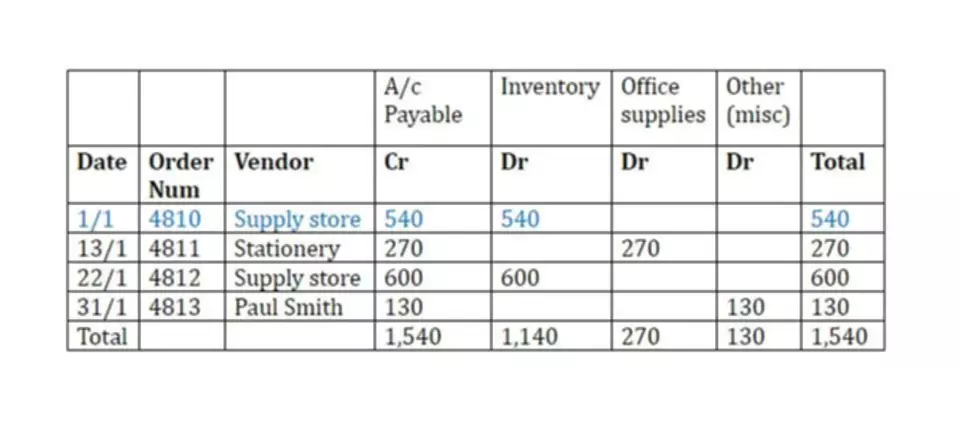

Debit refers to the opposite of credit, being any transaction that appears on the left side of an asset account. Property management accounting isn’t your typical business accounting. But without invoice and receipts management, that is difficult to achieve. But what is the difference between an invoice and a receipt in accounting terms?

However, nowadays, you’re doing yourself a great disservice if you’re not using accounting software of some kind. However, it’s easy to forget and lose track of, which can wreak havoc on your accounting. So, make sure to be proactive about setting up a system for managing it. One of the most critical parts of that https://www.bookstime.com/articles/property-management-accounting is tracking your deductible expenses, which can significantly reduce your tax bill at the end of the year. For example, when you run reports or review parts of your accounting with your accountant, you’ll have a better idea of what they’re talking about and be able to offer more accurate and valuable input.

Rapid growth and smart automation – Alliance Managing Agents gain an edge on…

The cash accounting method records transactions when they’re either paid or payment is received (depending on whether you’re paying a bill or receiving a payment from a tenant). What is the best way to handle all of your property management accounting needs? Investing in high-quality property management accounting software is the answer that comes to mind. This type of bookkeeping is the go-to option for a smaller property management accounting system. If the transaction activity is minimal, a single entry approach is sufficient.

- Accounts payable refers to what your business currently owes from vendors.

- Positive cash flow does not always equate to a positive financial standing.

- Although regulations vary by state and jurisdiction, there are several key guidelines that can help you structure the financial operations of your company in a way that ensures your compliance.

- A property management company can handle the day-to-day tasks of managing your rentals.

- Another tip to streamline your property management accounting is to set up a separate bank account for each property that you manage.

We believe that better banking products can make the whole financial system more inclusive. These are important to have, but you do have the flexibility to tailor your chart of accounts to the needs of your business. Pondelli says you can keep your chart of accounts as high-level or as granular as you like. Property management accounting can be difficult and time-consuming, but software like DoorLoop makes it simple and even allows for Quickbooks integration, placing everything under one roof.

How to Find the Best Property Manager: 9 Factors to Consider

Hiring a virtual assistant can help you streamline your accounting needs. Wishup’s dedicated bookkeeping team, with extensive knowledge and experience, can meet all your bookkeeping needs. Our bookkeeping assistants are eager to use their years of bookkeeping experience to help you with all the tasks required. For example, if you’re having issues tracking your property management fleet and you’ve managed your budget correctly, you can afford to optimize your fleet with a field service management solution. So, let’s first begin with what is bookkeeping for property management. Full-time property management isn’t just paying rent and fixing basic household items.

- There are dozens of potential deductions when it comes to rental property management.

- Your accounting practices will center around this chart of accounts, with each business transaction recorded in one of these areas.

- Property managers are typically expected to monitor an owner’s real estate income, assets, and expenses and implement accounting procedures that support sound business growth and profitability.

- As a property manager, it is essential to comply with federal, state, and local regulations that affect your accounting practices.

- Once you have the right accounting systems in place, it’ll be time to invest in property management accounting software.

- Gross profit equals revenue minus your cost of goods sold, which simply refers to the cost of offering your services.

Commentaires récents